Updated yearly, the Arton Index is an overall assessment and comparative benchmark of the country and its investment program.

9,915,803

Population Growth: 0.58%

47,792 USD

GDP (per capita)

GDP (purchasing power parity)

686 billion USD

179

Visa free countries

LOCATION

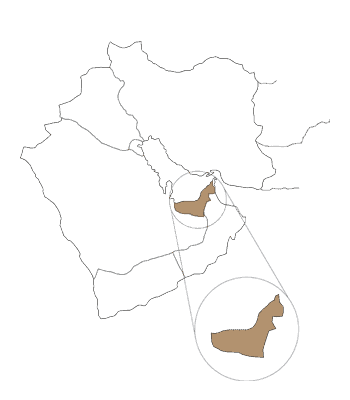

Middle East

CAPITAL

Abu Dhabi

DIFFERENCE

UTC +4

TOTAL AREA

83,600 sq. km.

AGE DEMOGRAPHICS

0-14: 14.94%, 15-24: 12.36%, 25-54: 64.15%, 55-64: 6.59%, 65+: 1.96%

LANGUAGE

Arabic: 77%, English: 67%

RELIGIONS

Islam: 76%, Christianity: 9%, Hinduism: 8%, others: 7%

GOVERNMENT TYPE

Elective monarchy

CURRENCY

UAE Dirham (AED)

EXCHANGE RATE

1 USD = 3.67 AED

The United Arab Emirates (UAE) is a melting pot of cultures, a strategic business center, and a haven for investors. Here’s why you should consider the UAE for your business ventures:

Strategic Location:

- Situated at the crossroads of major continents, the UAE offers excellent connectivity for global trade.

Business-Friendly Environment:

- The UAE government actively promotes business formation with initiatives like the Golden Visa.

- This visa grants expats residency for up to 10 years, allowing them to live, work, and study in the UAE without a national sponsor.

- There are no corporate taxes and high economic diversity, creating a fertile ground for businesses.

Unmatched Infrastructure:

- State-of-the-art infrastructure ensures smooth operations and efficient logistics.

Diverse Company Setup Options:

- Depending on your business goals, you can choose from various license categories: Professional, Commercial, Trading, Industrial, and Tourism.

Qualifications

Flexible Company Registration Pathways are as under

Mainland

Ideal for global trading with both local and international markets.

Offshore

Perfect for tax optimization and operating outside the UAE.

Free Zone

Offers 100% foreign ownership and tax concessions, but limits trade within the free zone and outside the UAE.

Flexible Company Registration Pathways:

- Mainland: Ideal for global trading with both local and international markets.

- Free Zone: Offers 100% foreign ownership and tax concessions, but limits trade within the free zone and outside the UAE.

- Offshore: Perfect for tax optimization and operating outside the UAE.

Selecting the Right Jurisdiction:

Our consultants can help you select the most suitable jurisdiction based on your business activity, structure, and need for a physical office. Here are some top options:

- Department of Economic Development (DED) Dubai Mainland: Ideal for businesses targeting the Dubai and UAE markets.

- Dubai Multi Commodities Center (DMCC): A globally recognized free zone for corporate businesses seeking a physical presence.

- Jebel Ali Free Zone (JAFZA): A trade hub for industrial businesses with world-class port facilities and logistics infrastructure.

- Meydan Freezone: A haven for freelancers and startups, offering competitive licensing options and support systems.

- Ras Al Khaimah International Corporate Centre (RAK ICC): One of the world’s fastest-growing corporate registries for setting up offshore operations in the UAE.

Golden Visa for Investors:

-

- Invest AED 2 million (approx. US$545,000) in property or an investment fund.

- Secure a 10-year visa with the ability to include spouse, children, and certain employees.

- Enjoy extended periods outside the UAE while maintaining residency.